Capital Markets

DIGITIAN Capital has launched its pioneer private Multi-Asset and Separately Managed Accounts(SMA) named

“DIGITIAN Emerging Market Dynamic Multi-Asset SMA ”.

Separately managed accounts (SMAs) provide shareholders the opportunity to build a multi assets portfolios through a personal and flexible approach.

Separately managed accounts (SMAs) are the investment vehicle of choice among high net worth ishareholders seeking sophisticated investment solutions and direct ownership of securities in their accounts.

Establishing an SMA is a consultative process. SMA shareholders typically work with the promoters to establish personalized strategy. SMA owners also may have access to our research, A higher level of service than other retail investment solutions, and may include periodic reports summarizing account activity and performance, as well as in-person meetings, conference calls and written commentaries.

Unlike other pooled vehicles, SMA Shareholders can:

- Impose reasonable restrictions on the management of their accounts

- Impose reasonable limits on the amount of gains or losses recognized in their accounts

Overall Investment strategy

This investment strategy seeks current income and to a moderate extent long-term capital appreciation. Over the long term, the strategy generally seeks to have a level of risk lower than that of a blended benchmark of 60%-80% of global stocks and 20%-40% core bonds. It provides research to invest in a diversified portfolio of equity, fixed income including non-traditional mutual funds and exchange traded funds.

Stock :

STOCK Selection approach

- Seeks long-term capital appreciation and Dividend income

- Broadly diversified in international emerging markets in Africa, Middle East, India and USA

- Mainly focus on Industries which has a Digital Future

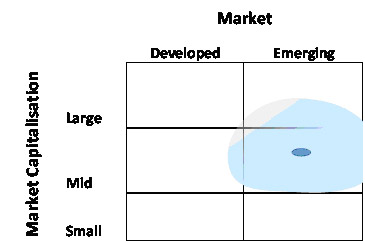

- Spans growth and value stocks and market capitalizations with Focus on Large/Mid Cap

- Minimal public sector dependency

- Attractive industry structure with proven, profitable and sustainable business model

- Distinct competitive advantage driving strong market position

- Talented and visionary entrepreneur/majority shareholder/management team

- Clearly identifiable and implementable levers for value creation

- Appropriate corporate governance

The expected exposure to each Market :

Emerging Market Distribution

| Region | Benchmark |

|---|---|

| India | 50.00% |

| Kenya | 20.00% |

| Tanzania | 5.00% |

| South Africa | 10.00% |

| Other | 15.00% |

| Total | 100.00% |

Focus Industry Segment

- Auto companies increasing their electric vehicle manufacturing capacity

- Utilities especially Green Energy companies(Solar, Hydro ) ramping up investment into energy services and grid digitalisation

- Infrastructure firms adopting more sustainable building materials (Environment Friendly) into construction projects

- Mining companies utilising big data analytics to streamline operations and boost energy and operational efficiencies

- Information Technology specialising digital platforms, Artificial Intelligence

- Banking/ Housing Finance /NBFCs/Microfinance Companies in digital space

Sector weightings

| Sectors | Benchmark |

|---|---|

| BFSI | 20% |

| Information Technology | 15% |

| Energy | 8% |

| Retail | 9% |

| Materials | 8% |

| Industrials | 8% |

| Infrastructure | 7% |

| Telecommunication Services | 10% |

| Utilities | 3% |

| Real Estate | 7% |

| Health Care | 3% |

| Other | 2% |

| Total | 100% |

Sector categories are based on the Global Industry Classification Standard, except for the “Other” category

Principal Risks

The Research and Advisory is subject to the following risks, which could affect the performance:

- Stock market risk, which is the chance that stock prices overall will decline. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices. The Fund’s investments in foreign stocks can be riskier than Investors’ Home Market investments. The prices of foreign stocks and the prices of Home Market stocks may move in opposite directions.

- Emerging markets risk, which is the chance that the stocks of companies located in emerging markets will be substantially more volatile, and substantially less liquid, than the stocks of companies located in more developed foreign markets because, among other factors, emerging markets can have greater custodial and operational risks; less developed legal, tax, regulatory, and accounting systems; and greater political, social,

and economic instability than developed markets.

Country/regional risk, which is the chance that world events—such as political upheaval, financial troubles, or natural disasters—will adversely affect the value of securities issued by companies in foreign countries or regions. Because the Fund may invest a large portion of its assets in securities of companies located in any one country or region, the Fund’s performance may be hurt disproportionately by the poor performance of its investments in that area. Country/regional risk is especially high in emerging markets.

- Currency risk, which is the chance that the value of a foreign investment, measured in U.S. dollars, will decrease because of unfavourable changes in currency exchange rates. Currency risk is especially high in emerging markets.

- Investment style risk, which is the chance that returns from the types of stocks in which the Fund invests will trail returns from global stock markets. Small-, mid-, and large-cap stocks each tend to go through cycles of doing better—or worse—than other segments of the stock market or the global market in general. These periods have, in the past, lasted for as long as several years. Historically, small- and mid-cap stocks have been more volatile in price than large-cap stocks.

- Manager risk, which is the chance that poor security selection will cause the Fund to underperform relevant benchmarks or other funds with a similar investment objective. In addition, significant investment in the some sectors subjects the Fund to proportionately higher exposure to the risks of this sector.

Fundamentals

| Key Indicators | Benchmark |

|---|---|

| Number of stocks | 50 |

| P/E ratio | 14.8x |

| P/B ratio | 1.8x |

| % Emerging | 95% |

| % Developed | 5% |

Risk and volatility

| Key Indicators | Benchmark |

|---|---|

| R-squared | 0.97 |

| Beta | 1.01 |

| Alpha | N/A |

| Standard deviation | 0.1573 |

| Sharpe ratio | 0.28 |

An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Sovereign Deposit Insurance Fund on or any other government agency.